In 2024, Texas homeowners will see significant changes to property tax exemptions. Proposition 4, passed in November 2023, increased residence homestead exemption from $40,000 to $100,000 - a move largely heralded by Dallas homeowners who need property tax relief.

Navigating property taxes can be overwhelming for homeowners, but the homestead exemption offers enough financial relief to justify applying for it. This guide breaks down everything you need to know about homestead exemption in Dallas County, including its importance, eligibility criteria, application process, benefits, and recent legislative changes.

Don’t let anxieties about complex tax laws stop you from getting tax relief. We aim to make complex tax laws more accessible and actionable for Dallas residents.

Legal Framework

The homestead exemption in Texas is anchored in the Texas Property Tax Code, particularly Section 11.13, which allows property owners to receive partial or total exemptions from their property’s appraised value. This initiative reduces the overall tax burden faced by citizens. The Texas Comptroller of Public Accounts highlights:

“Texas offers a variety of partial or total exemptions from appraised property values used to determine local property taxes. These exemptions are granted by the Texas Constitution or state law” [1]

In Dallas, the Dallas Central Appraisal District (DCAD) administers these exemptions, ensuring they are applied in accordance with local needs and regulations. This local governance ensures homeowners get precise guidance tailored to their circumstances.

If you’re interested in what lawmakers put into the tax cut plan approved in 2023, you can find that information further down in the article.

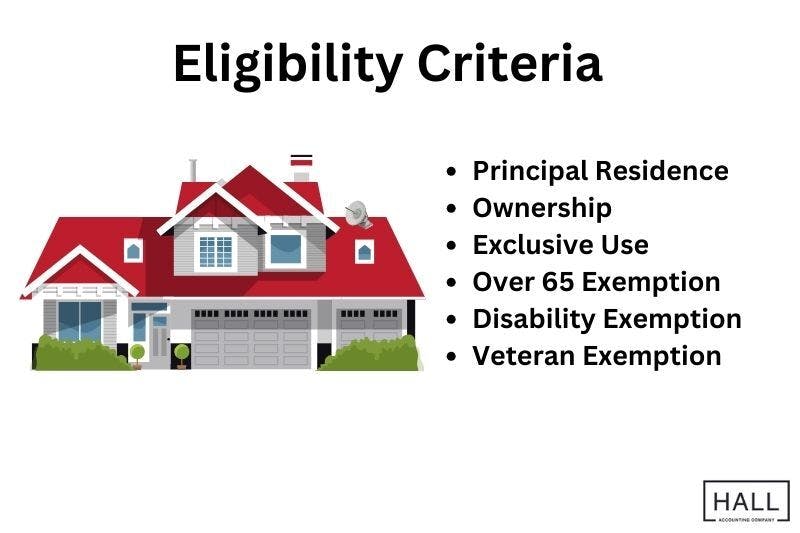

Eligibility Criteria

To qualify for the homestead tax exemption in Dallas, you must meet specific requirements.

Principal Residence - The property must serve as your primary residence as of January 1 of the tax year.

Ownership - You must have owned the property by January 1 of the tax year.

Exclusive Use - You cannot claim the homestead exemption on any other property.

Additional exemptions are available for specific groups, including:

Over 65 years exemption - Additional tax relief for homeowners aged 65 years or older. If your application is approved, you will receive the exemption for the entire year in which you become age 65 or disabled and for subsequent years as long as you own a qualified residence homestead. [2]

Disability exemption - Extra relief for disabled homeowners who qualify to receive disability benefits under the Federal Old-Age, Survivors, and Disability Insurance Program administered by the Social Security Administration.

Veteran exemption - Tax exemptions for disabled veterans and surviving spouses of veterans who died in action.

Further reading: When Is Property Tax Due In Texas

Application Process

Applying for residence homestead exemptions is a relatively straightforward process but requires careful attention to detail.

Obtain the application form: Download Form 50-114 from the Dallas Central Appraisal District website or pick it up at the DCAD office.

Complete the form: Make sure to fill in the form accurately, including the property address, proof of ownership, and personal identification. Any missing information will delay your application.

Submit the form: Send the completed form and required documents to the DCAD office or submit it online. The deadline is Apr 30 of the tax year for which you are applying.

Provide required documentation: Include proof of ownership (e.g., a deed), a valid Texas driver’s license or state ID matching the property address, and any additional documents needed for specific exemptions (e.g., proof of age, disability, or veteran status).

Once granted, the exemption remains in place as long you reside in the property, without the need for annual reapplication. Moreover, the exemption can be retroactive for up to two years, which can provide immediate backdated relief for new applicants.

We’d love to help you manage not only your property taxes but your total tax liability. With Tax Planning Services from Hall Accounting Company, you can reduce your financial burden, and use your hard-earned dollars to invest in things you need and care about.

The impact of tax exemptions on your taxes

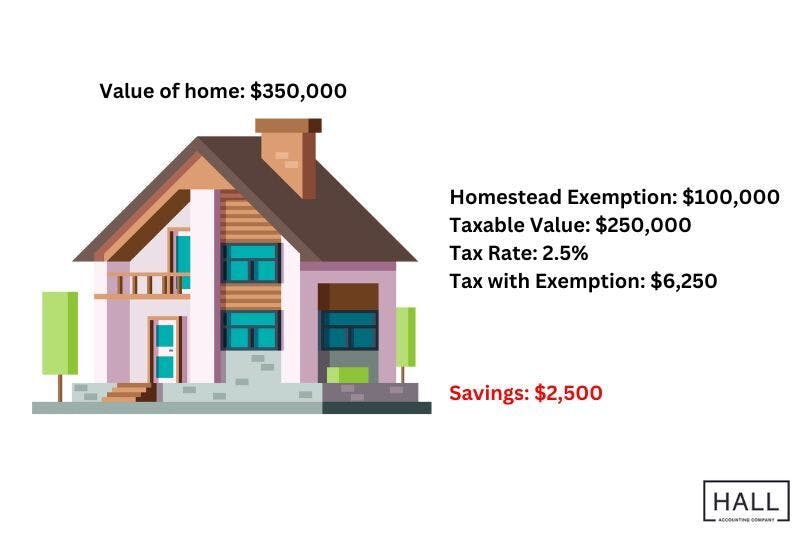

The primary benefit of the homestead exemption is the reduction in property taxes. By lowering the appraised value of a home, the exemption directly decreases the tax burden. For example, with the recent increase from $40,000 to $100,000 in the exemption amount, a homeowner with a $350,000 home would see their taxable value reduced to $250,000, resulting in significant savings.

To illustrate:

Common issues and solutions

Despite its benefits, the residential homestead exemption can sometimes present challenges. Here are the common problems and their solutions.

Incomplete applications

Every tax year a number of homeowners delay their exemption application until the last minute - we can chalk this down to human nature. Applications are hurriedly completed online or manually, and important information is omitted in this haste. Unfortunately, this causes a negative response from the DCAD, who cannot properly assess the exemption eligibility with missing information.

Solution: Make sure that all sections are completed and that all requested documentation is provided. This will move your application along more quickly.

Incorrect Information

Similar to incomplete information, this is about making unnecessary mistakes. Addresses, ownership information, age, disability status, and veteran status must be accurate.

Solution: Double-check all information, especially ownership information and addresses.

Missed deadlines

There are very strict deadlines for the exemption process to be finalized by school districts. The general residence homestead exemption is due by Apr 30 of the tax year. The local appraisal district is often under pressure to get property taxes in, because they are used to fund local initiatives, and so they’re sticklers for deadlines.

Solution: Mark the dates on your calendar and don’t wait to get your application in.

If you feel like you’re going to miss your tax deadlines, maybe it’s time for some help with your taxes. Let us do your tax planning and preparation so you can focus on other things.

Yes, I need help with my taxes

Further Reading: How Much Does Tax Planning Cost: Dallas SMEs

Legislative changes

Legislative changes passed in November 2023, have increased tax exemptions in school districts to $100,000. This change is part of a $18 billion property tax relief initiative, aimed at providing Dallas residents with greater incentives to purchase homes. These tax cuts also serve to attract high-income earners and the self-employed to the state of Texas.

Governor Greg Abbot issued the following statement, shortly after the plan passed.

"I made a promise to Texans during my campaign that the State of Texas would use at least $13.5 billion from our historic budget surplus to provide substantial relief to property taxpayers across Texas. Today, we will deliver even more with over $18 billion in property tax cuts. The Texas House and Senate fulfilled our promise with an agreement that delivers a comprehensive, long-lasting solution to increasingly burdensome property tax bills. I thank my partners in the Texas Legislature for coming together to honor the best interests of hardworking Texans who want to own their property—not rent it from the government. I look forward to signing this legislation into law to provide Texans with the largest property tax cut in Texas history.” [3]

He was joined by speaker Phelan, who had this to add:

“I am thrilled to announce the overwhelming passage of the House and Senate’s omnibus property tax legislation. The passage of this $18 billion package is a testament to the unwavering commitment of Texas leaders to address the concerns of taxpayers and provide significant relief from the burden of escalating property taxes. I want to express my gratitude to the Lieutenant Governor for his productive negotiations on this matter, to State Representatives Will Metcalf, Morgan Meyer, and Charlie Geren for their relentless work to get these bills over the finish line, and to all the members who voted to give Texas property owners the largest state property tax cut in this nation’s history. Their dedication and leadership have been instrumental in making this historic achievement possible, and Texas taxpayers will be the winners because of it.” [3]

What’s in the plan?

School Tax Compression | About $7.1 billion will be sent to Texas school districts so they can lower the taxes they levy on property owners. The move, known as “compression,” will reduce the school district’s maintenance and operations property tax rate by 10.7 cents per $100 of a property’s valuation. |

$100,000 homestead exemption | An estimated $5.6 billion will be used to more than double the current $40,000 property tax exemption available to all Texans who own the home that serves as their primary residence. |

Temporary 20% appraisal cap | The law will establish a limit on appraisals for commercial, mineral, and residential properties that do not have a homestead exemption and are valued under $5 million. |

Franchise tax exemptions | The legislation — which is not a property tax cut but was included in the package as another tax relief measure — would double the amount of money a business can make before it’s required to pay the state’s franchise tax. |

Elected appraisal officials | Under the new legislation, each appraisal district’s board of directors will now include three positions elected by a majority vote at a county general election for four-year terms. |

Additional provisions

The legislative changes also address potential issues related to a temporary absence from the homestead. Homeowners can maintain their exemption if they move away temporarily, provided they do not establish a primary residence elsewhere and intend to return within two years. This flexibility is particularly beneficial for those who may need to relocate for work or health reasons.

Frequently Asked Questions

1. Can multiple owners qualify for the Homestead exemption?

If the property has multiple owners, such as in the case of an heir property owner, each owner's share of the exemption is based on their ownership interest in the property. Specific rules apply to community property and inherited properties.

2. What happens if my property value changes due to improvements?

If you make significant improvements to your home, the appraisal district will reassess the property's value. The homestead exemption amount may be adjusted based on the new appraised value, but you will still benefit from the reduced taxable value.

3. Are there any penalties for not applying for the Homestead exemption?

While there are no penalties for not applying, failing to claim the homestead exemption means you will miss out on potential tax savings. It's advisable to apply as soon as you become eligible to take full advantage of the benefits.

4. Can I transfer my Homestead exemption to a new property?

No. You must apply for the exemption on the new property and notify the appraisal district of the change.

5. Can I claim a Homestead exemption on a second home or rental property?

No, the homestead exemption is only available for your primary residence. You cannot claim the exemption on a second home, rental property, or any other property you do not live in as your principal residence.

In Closing

This exemption provides significant financial relief by reducing your property tax burden. We've covered the essential aspects, including eligibility criteria, the application process, recent legislative changes, and additional benefits for seniors, disabled individuals, and veterans.

Remember, the application process is straightforward, but attention to detail is critical. If you have any questions or need further assistance, the Dallas Central Appraisal District (DCAD) website offers comprehensive resources, or you can consult with one of our tax accountants.

References:

1. https://comptroller.texas.gov