The yearly cost of an in-house bookkeeper for the state of Texas ranges between $47,400 and $50,320. On the other hand, a qualified CPA can command up to $90,130 in Texas. Therefore the amount you pay will largely depend on the skills you need. [1]

As a small business owner, you’re probably wrestling with a difficult catch-22 situation. You need a bookkeeper or an accountant to help you steer your finances in the right direction, thereby meeting all your financial obligations, but you also need to generate enough money to afford this kind of expense.

After you’ve been in business a little while, bookkeeping services become a no-brainer decision because you begin to feel the effects of muddling through financial transactions, accounting software, and tax legislation on your own. It’s stressful when you don’t have all the expertise you need, and anyway, you’re trying to focus on your products or services. You want the expertise, but how are you going to afford it?

In this article, we explore some options for small business bookkeeping services. We also look at the cost of full-service accounting options for those who are ready to get started.

Ready to discuss bookkeeping services for your Texas business? Hall Accounting Company offers basic bookkeeping, full-service accounting, and virtual CFO services. Contact us today for a free initial consultation to discuss your needs.

Further Reading: Virtual CFO Cost Analysis: Dallas

What will a bookkeeping service do for you?

Bookkeeping is the backbone of any successful business. Accurate and timely bookkeeping not only ensures compliance with tax regulations but also provides a clear picture of your company’s financial health.

Unfortunately, many small business owners struggle to maintain financial records. Common issues include missed deadlines, errors in financial statements, and a lack of financial insight. This can lead to significant problems that will cost you in overpaying taxes, tax penalties for missed deadlines, and even financial mismanagement.

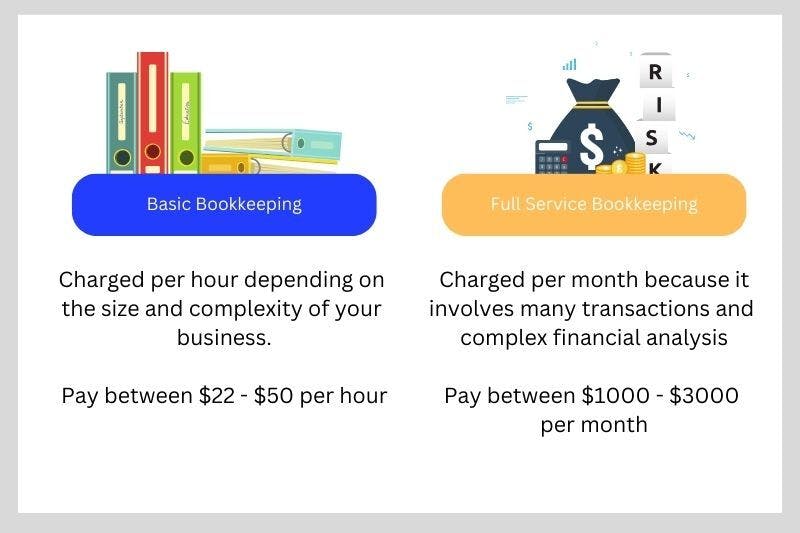

A dedicated bookkeeper can help avoid these pitfalls, making an hourly rate of $22 - $50 worth the investment for basic services.

In-house bookkeeping, or even an outsourced bookkeeper will provide a more comprehensive service.

Manage invoices and payments that the business is owed by customers (accounts receivable).

Manage bills and payments that the business owes to suppliers, vendors, and creditors (accounts payable).

Track business expenses and keep them under control.

Manage employee salaries, wages, and taxes, as well as prepare and file payroll tax reports.

Ensure your business meets sales tax obligations.

Manage your taxes according to state and federal regulations.

Reconcile all bank accounts and highlight abnormal transactions.

Ensure your business remains tax-compliant.

Assist you in managing your cash flow by providing regular reports, or access to accounting software dashboards that update your figures in real-time.

Feeling confident that these services meet your needs? Call Hall Accounting Company today. We are based in Dallas, TX, and also offer online bookkeeping services.

Basic bookkeeping vs. full-service bookkeeping cost

It might be a good idea to help you distinguish between these two services and why they vary in cost. This will allow you to make a choice based on your business needs as well as your budget.

Basic bookkeeping

This includes tasks such as:

Recording daily transactions (manual data entry or automation-driven)

Managing accounts payable and receivable

Reconciling bank statements

Preparing basic financial reports

Sometimes this can be all you need to keep your finances in line, and yourself tax-compliant. Instead of having a monthly bookkeeping cost you can pay an hourly rate. Hire a bookkeeper on a freelance basis or according to an average hourly rate. Agree on a number of outcomes for this rate such as all transactions recorded on the accounting system, and reconciliation of bank statements. Accounting or CPA firms in Dallas also offer more flexible basic bookkeeping services if you find the right one. They have a range of clients and offer specific packages for small business owners.

In-house bookkeeping for this function is not ideal for dealing with very basic accounting tasks unless the person is willing to work on a part-time basis. If you want to keep your costs down to the bare minimum for bookkeeping, invest in this service.

Further reading: How Much Does Tax Planning Cost: Dallas SMEs

Full-service bookkeeping

The average hourly wage for this function will be much higher than basic services. You can expect to pay between $50 and $300 for a certified public accountant. Of course, this is a highly skilled professional who will be capable of steering your business in the right direction and get involved in complex financial decision making.

These services include:

Basic bookkeeping plus;

Payroll processing (Employee timesheets, independent contractors, employee benefits, and taxes).

Proactive tax planning and allowable tax deductions.

Tax preparation, filing, and audit representation.

Budgeting and forecasting.

Detailed financial analysis and reporting.

Advisory services.

Full-service bookkeeping is suitable for businesses with more complex financial needs or those looking for strategic financial planning and analysis.

In Texas, the average cost of outsourcing bookkeeping services tend to be quite high due to the competition and high level of expertise. This is also due to expanding commerce and industry in Texas that is attracting high income earners, start-ups, and big corporations because they enjoy significant tax breaks in the state.

Further reading: Why You Should Outsource Bookkeeping As a SBO

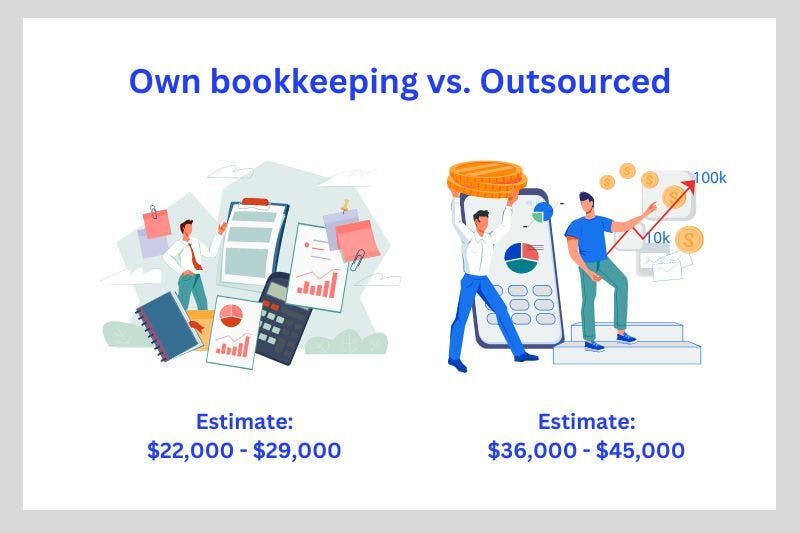

Cost Comparison: Own bookkeeping vs. Outsourced bookkeeping

Further reading: Cost to Outsource Accounting Functions: Small Business Accounting

Looking at these conservative estimates for accounting services in Texas may encourage you to do your own bookkeeping, and that’s ok if you make that decision. However, it’s important to understand the kind of effort and skill that will be required from you to achieve the same quality as a professional bookkeeper. The cost of acquiring the skills, as well as the cost of errors, missed deadlines, and possible tax issues is not included in this amount.

So, what would motivate you to pay for a part-time bookkeeper to handle your financial data and take care of your bookkeeping needs? Let’s consider some of the benefits.

Benefits of hiring a bookkeeper

Reduced errors and financial oversight

Offloading the responsibility of keeping your financial transactions current and organized, not only is your time freed up, but you also reduce the risk of errors and discrepancies that could potentially lead to costly financial missteps or compliance issues.

This level of meticulous financial oversight ensures that you are always prepared for audits and can make financial decisions with confidence, ultimately contributing to the stability and long-term success of your business.

Payroll is handled with accuracy and professionalism

Payroll is handled with utmost accuracy and efficiency, and as a result, you not only protect your business from potential legal and financial penalties but also strengthen your reputation as a reliable employer.

This reliability can make your company more attractive to high-caliber talent, who value stability and professionalism in their employer. In turn, attracting and retaining such skilled employees can drive innovation and performance, setting your business apart in a competitive market.

High level of financial transparency

A qualified professional maintaining vigilant oversight of your financial accounts and flagging unusual transactions will safeguard your company's assets. This high level of financial clarity and transparency can help you identify cost-saving opportunities and optimize spending, enhancing your operational efficiency.

Avoid the pitfalls of DIY bookkeeping. Discuss your bookkeeping needs with one of our professional and highly skilled accountants. We’ll help you find a solution that works for your business and your budget.

CONTACT HALL ACCOUNTING COMPANY

In conclusion

The cost of bookkeeping services in Texas can vary significantly depending on whether you choose to manage it in-house or outsource to a professional firm. Amounts range from $36,000 to $60,000 but they can also be higher.

The best advice we can give you is to shop around. Schedule a few meetings, discuss your needs with the companies you’ve decided on, and listen carefully to their service offering and price range. You might find your perfect match quickly, or you might have to start your search from scratch. Once you find an accountant, bookkeeper, or accounting firm that is interested in working with you, and that you really like, sign on the dotted line and take a well-deserved break from crunching numbers.

While you go through this process it’s important not to be short-sighted about it. A short-term saving of a few hundred dollars a month could cost you thousands of dollars in the future.

If you’re curious about what an outsourced accounting firm can do for you, start your search with Hall Accounting Company. Give us a call today and start negotiating your way out of a mountain of financial transactions and tax headaches.

Reference: