Filing back taxes without the necessary records can be a daunting task, but it's crucial to address unfiled tax returns promptly to avoid potential penalties and interest.

This article outlines the steps to file back taxes without records, emphasizing the importance of compliance and the resources available to facilitate the process.

Why it's important that your tax filings are up to date

Simply put, the consequences of having outstanding tax filing can be serious and lead to troublesome financial outcomes and problems with the IRS. Said consequences will include

penalties, interest charges, and potential legal action.

Additionally, unfiled returns may result in the loss of potential refunds or tax credits if not claimed within a specific timeframe. The IRS only allows taxpayers to claim refunds and tax credits within three years of the tax return’s original due date.

If you have outstanding tax returns, now is the time to address the problem before any further challenges arise. Get in touch with a tax professional today and get expert help completing your outstanding federal income tax return.

Steps to file back taxes without records

Whether you contact a tax professional, or go it alone, you will need to understand the steps needed to correct the situation you find yourself in.

What follows is a step-by-step action plan that will help you gather information, deal with past due tax returns, remit with unpaid taxes, and consult the internal revenue service regarding penalties and interest charges.

1. Reconstruct income information

The first step is to gather outstanding information and request your wage and income transcripts from the IRS. The IRS maintains records of income reported by third parties, such as employers and financial institutions. Tax transcripts can include:

Past tax forms.

Information submitted on W-2s and 1099s.

Tax account transcripts.

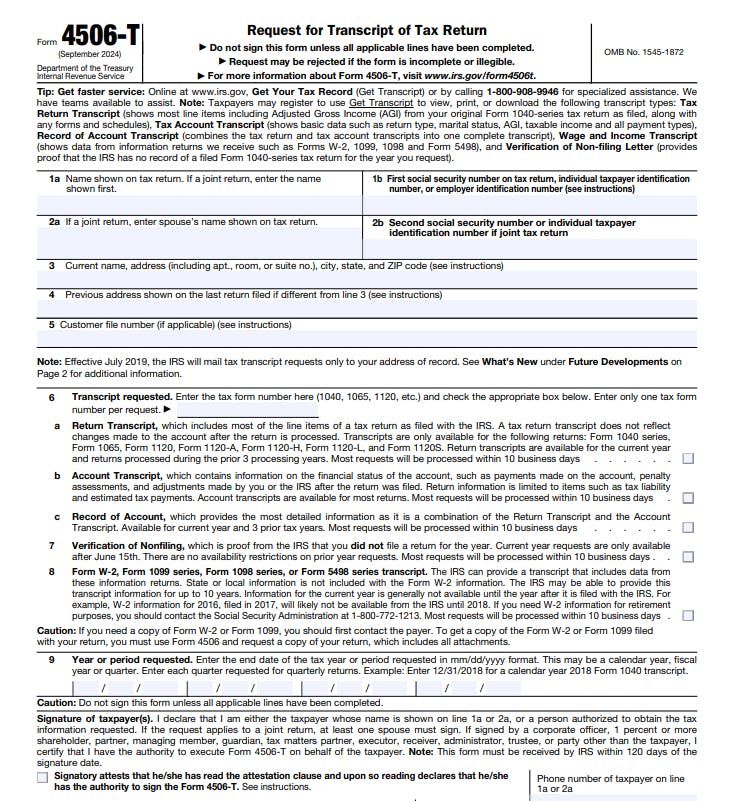

To obtain these tax records, you can request them online using the IRS’s ‘Get Transcript’ tool to access your transcripts directly, or by mail, completing Form 4506-T, ‘Request for Transcript for Tax Return’, and then mail it to the IRS.

What is also helpful for collecting income information is copies of individual income tax returns you may have kept, previous bank statements, and other income documents (such as invoices, if you are a business).

If you are a business or self-employed and haven’t yet purchased accounting software to organize your financial records, now would be a good time to do so. These platforms are becoming more advanced with the inclusion of automation and data extraction, which can make doing your books and taxes a great deal easier.

Further helpful information: How To Read A Tax Return Line-by-Line

2. Reconstruct expense records

Accurately reporting expenses is essential to obtain an accurate taxable income, especially for self-employed individuals or those claiming deductions. To reconstruct expense records, do the following:

Bank and Credit Card statements: Retrieve past bank and credit card statements to identify and categorize expenses. These statements serve as a reliable source for tracking expenditures.

Contact vendors and service providers: Reach out to vendors, utility companies, and other service providers for copies of past invoices and payment records. For example, medical expenses, child care expenses, student loan repayments, etc.

Use IRS standard allowances: If specific financial records are unattainable, the IRS does provide standard allowances for certain expenses, such as vehicle mileage. Refer to the IRS guidelines for these allowances.

Business expenses: Refer to your business records, or accounting system to draw reports reflecting your total business income and expenses for working out estimated taxes.

Steps 1 and 2 may require a substantial amount of time, patience and focus to achieve, especially if your financial information is not readily available, or there is information missing.

Admittedly, this is where taxpayers can find themselves feeling frustrated, and despondent with the burden to file previous year’s taxes, but it’s worth persevering - even just for the peace of mind it will bring eventually.

Our team at Hall Accounting Company understands the frustrations of getting your tax and financial affairs in order when something has gone wrong. If you have back taxes and don’t know where to begin, give us a call today.

3. Obtain prior year tax forms

Each tax year has specific forms and instructions. For instance, legislation can change from year-to-year which dictates which credits, tax deductions, and tax refunds you can claim. This will affect your tax liability from year to year. Ensure you carefully work through the allowances for each tax year that is outstanding, as well as the correct forms you need to settle your tax bill.

You can download tax forms and instructions directly from the IRS website, or you can call them to requestthe prior year’s forms and publications.

If you owe taxes for more than one tax season, it is advisable to carefully work through one year at a time, taking particular note of the allowances that were applicable to your tax filing status and financial situation during that year.

This way, you will ensure your tax debt is dealt with accurately, and avoid further penalties and interest from wrong filings.

4. Prepare and file the returns

With tax transcripts and reconstructed income and expense records, you are now ready for filing prior year returns. You have three options for doing so:

Manually prepare returns: Complete the appropriate tax documents for each year. Ensuring all the income and deductions are accurately reported.

Use tax preparation software: Some tax software providers offer options to prepare previous year tax returns.

Seek professional assistance: Given the complexities involved in filing back taxes without records, consulting a tax professional can be very beneficial because it takes the stress of the process off your shoulders and gives you a knowledgeable partner who can deal with the IRS on your behalf. Sometimes, you just need a tax professional to deal with the IRS because they speak the same language.

A further benefit of using an experienced tax consultant is that they will claim tax refunds, deal with complex tax issues, and carefully follow IRS regulations. Some firms specialize in forensic accounting, with the express purpose of carefully reconstructing your financial records when they are missing or incomplete.

They are highly skilled at piecing together historical financial information. If your tax situation is particularly complex or involves difficult to understand legislation, then this service is highly advisable.

5. Establish a payment plan if necessary

Once you receive the outcome of your submissions, you will need to pay outstanding taxes and the penalties or interest associated with them. If you cannot pay the full amount owed:

Apply for a payment plan with the IRS to pay the tax debt owed.

If you qualify, negotiate a settlement for less than the total amount owed.

Often, a question about filing for bankruptcy arises, and whether you still need to submitthe previous year’s tax returns. The answer is yes. The bankruptcy process does require your taxes to be up-to-date, and some taxes may not be exempt from payment.

Further helpful information: Can You Keep Your Tax Refund After Filing Chapter 7?

Conclusion

Filing back taxes can be a stressful and overwhelming experience for most people. This is because most people do not have an indepth understanding of tax rules and regulations, and sometimes can unwittingly neglect to keep records that are important for tax filings.

If you are in a position to correct this matter immediately, it would be best if you get your back taxes resolved. The chances of it escalating into an even more difficult and complicated matter become higher the longer your taxes are outstanding.

It is highly advisable that you seek some form of help, either going to the IRS directly or getting the help of tax professionals who can help you work through the process we’ve described.

If you need help with your back taxes, contact Hall Accounting Company today. Our team of tax associates will help you gather outstanding information, correctly categorize expenses, help you claim tax credits, deductions, and exemptions, and represent you with the IRS. They will also help you prevent future taxation issues with tax planning services so that you never have to file back taxes without records again.