The multi-step income statement is a diagnostic tool. It not only provides a snapshot of financial health but also delves deeper into the operational effectiveness of the business. Understanding which sections of the income statement to scrutinize allows businesses to uncover hidden costs, assess their operations' efficiency, and identify growth and savings opportunities. It is one of the three major financial statements that report a company’s financial performance over a specific accounting period.

Understanding the flow of finances is like following a captivating story that holds your attention until the end. You involve yourself in each character’s development, wondering how they will develop and how their interactions with other characters will bring the whole plot of the story together. Finally, you feel that your investment in the story has been brought to a satisfying close - or not, depending on what you were hoping for.

This is similar to SBOs, who manage the intricate bits and pieces of their business and try to make it all work together. But how will you know that you’ve succeeded? And if you need to make changes to one or more parts that you are hoping work together as a whole, what information will you use to make those changes?

Multi-step income statements

This is where we introduce the answer to those questions by looking at a financial document called the multi-step income statement. Stick around for a while, and we’ll show how it’s different from single-step income statements and why it’s a better option for understanding different aspects of your business. We'll also give you some relatable practical examples.

Hall Accounting Company. Get back to doing what you love.

Before we move on, you may already know that you don’t want to deal with all the financial transactions and hassles of getting financial statements ready. If that’s you, schedule a consultation with Hall Accounting Company. With our deep understanding of financial principles and commitment to your business’s success, we can unlock the full potential of your multi-step income statement, transforming complex data into actionable insights.

Get back to doing what you love. Not tomorrow, not next week but today. Schedule a call and let’s work together to get your books on track, the numbers making sense and your strategies making an impact.

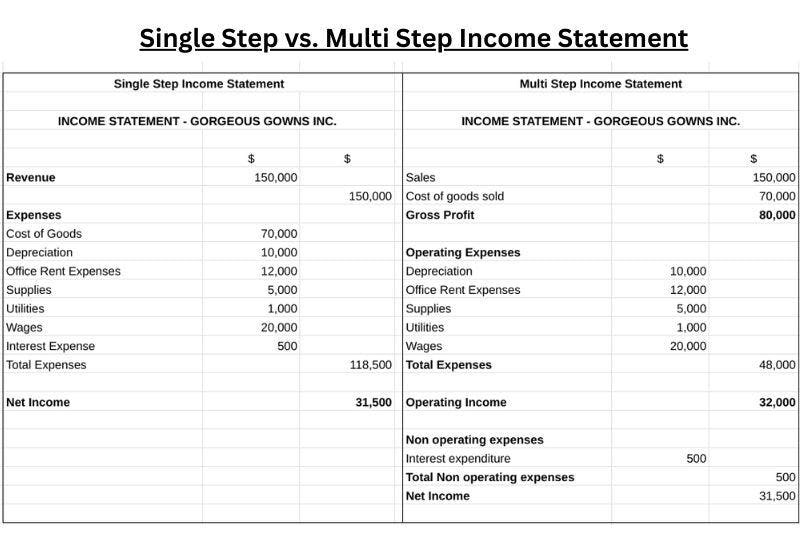

Differences between single-step vs. multi-step income statements

Above is an example of the basic differences between the two income statements. Should this small business want to draw up a simple income statement, it would look like the one of the left. Should they want to show the different aspects of their financial activities they would use the one on the right. This kind of income statement is called a multi step income statement.

Revenue

It begins with revenue, the gross income generated from sales or services, before deducting the cost of goods sold (COGS) to reveal the gross profit.

Operating expenses

Also known as administrative expenses or selling expenses, this first distinction offers immediate insight into the profitability of a company's core activities. However, the story doesn't end here. Operating expenses are then listed, including sales, general, and administrative costs, to arrive at operating income. This figure is critical, as it reflects the earnings from a company’s primary business activities, excluding the noise of secondary income or expenses.

Non-operating expenses

Beyond operating income lies a section for non-operating revenues and non-operating expenses, such as investment income or losses, and interest expenses. These items, while not directly tied to the core business operations, significantly impact the bottom line, showcased by the net income. This final tally reveals the company's profitability after all has been said and done, serving as a crucial indicator of financial health and sustainability.

But why does this matter?

For one, a multi-step income statement offers unparalleled transparency into a business's financial workings. By distinguishing between operating and non-operating activities, business owners can pinpoint where their company thrives and where it may be leaking resources. For example, a high gross profit but low operating income might indicate excessive operating expenses, signaling a need for cost management strategies.

Yet, for all its benefits, crafting and analyzing a multi-step income statement requires expertise. The detailed categorization, the nuanced understanding of what constitutes an operating versus a non-operating activity, and the ability to interpret the figures for strategic planning are skills honed through experience.

Practical Example: Software development company

Image courtesy of Canva Pro

In its early stages, a company can struggle to gauge the profitability of its operations. The introduction of a multiple step income statement can transform their approach to financial analysis.

Let’s call our fictitious company, FreshStart Tech. They represent a small business in the software development industry.

In one fiscal year, FreshStart Tech reported revenue of $500,000. The COGS, primarily software licenses and subcontractor fees, amounted to $200,000, leaving a gross profit of $300,000.

Effective decision making

This initial analysis highlighted the robust markup on their services. However, total operating expenses told a more nuanced story. Marketing costs, employee salaries, and office expenses total $180,000. While FreshStart Tech still has a healthy operating income of $120,000, the detailed breakdown of expenses sparked a realization—their marketing strategy is not as cost-effective as it could be.

Further, a small section of non-operating expenses, including interest expense on a small business loan, amounted to $20,000. Ultimately, FreshStart Tech’s net income stands at $100,000. While profitable, the detailed insights from the multi-step income statement prompted strategic shifts, particularly in marketing spend and debt management.

Bookkeeping - the foundation of the income statement

If you’re itching to get your hands on relevant financial data like this, you are not alone.

At Hall Accounting Company, we've seen firsthand how our bookkeeping services can transform raw data into actionable insights such as the ones mentioned above.

Without accurate bookkeeping, any financial analysis, including that derived from a multi-step income statement, risks being skewed or outright misleading.

When you partner with us our first step will be to overhaul your bookkeeping system, ensuring every transaction is recorded with precision and allocated to the correct category.

Further reading: Top Accounting Problems a Small Business Faces Today

Reduce your tax liability.

Referring back to FreshStart Tech and focusing on innovative products and market success, you might say that their net income is not reflective of their potential, primarily due to a lack of tax planning.

Once an accurate income statement is finalized several key areas can be scrutinized to leverage tax credits and deductions, specifically around R&D expenditures and investment in new technology.

This is where taxation services add great value to a small business. By applying for R&D tax credits and optimizing deductions for new software development tools, FreshStart Tech can significantly reduce its taxable income.

Don't let the complexities of taxation overshadow your business's potential. Partner with Hall Accounting Company and turn taxation into an opportunity for growth.

Benefits of a multi-step income statement

A multi-step income statement is more than just a ledger of numbers; it is a narrative of a business's financial journey over a specific reporting period.

To put forth the benefits of having an accurate income statement, we would like to provide you with more practical applications of the information it can offer.

Local restaurant chain - A local restaurant chain has been struggling with fluctuating profit margins but can't pinpoint the cause due to disorganized financial records. A detailed categorization of expenses in the operating expenses section would reveal the disproportionate costs associated with an underperforming location, as well as the high costs related to food wastage. The gross profit margin could help the chain understand how its revenue covers the cost of goods sold, while the net income provides a clear picture of its overall profitability.

Do you also need help with disorganized financial records? Get a quote for bookkeeping services.

E-commerce company: A mid-sized e-commerce company faced stagnation after years of rapid growth. They had data but lacked actionable insights to drive further expansion. A strategic analysis of their multi-step income statement identified that the company's shipping costs were disproportionately high, and their marketing spend was not generating the expected return on investment. By reallocating resources to optimize shipping contracts and refocus marketing strategies towards more profitable channels, the company achieved an increase in net profit.

Do these problems sound familiar? Schedule a call with an experienced fractional CFO.

Further reading: Fractional CFO Hourly Rate and Services for Small Business

Concluding Thoughts

The power of a multi-step income statement for an SBO lies in its ability to provide more accurate financial information about the trading activities of your business. Without it, finding solutions to your business problems is like searching for a needle in a haystack. You won’t know where to start and the chances are you won’t find it.

This isn’t the kind of frustration we want to see our clients go through. At Hall Accounting Company, we know that every SBO needs a helping hand to get their bookkeeping system in order, pay their taxes, and make sound business decisions. In this article, we’ve advocated for using the income statement as a way to achieve this.

Without the proper expertise to make sense of what you’re looking at, it’s all just numbers on a page. We’re offering our expertise and that chance for you to do what you love while we work on the number and provide accurate financial statements that you can trust.

If this sounds like something you’d like to discuss further, then schedule a consultation and we’ll do what we can to accommodate your bookkeeping, taxation, and fractional CFO needs.

Turn your financial statements into powerful decision-making tools with Hall Accounting Company.