Startups and small businesses face new decisions and questions daily.

Add in economic uncertainty, and you can just imagine the challenges.

Yet, one thing can make a huge paradigm shift – taking help from a reputed financial team providing CFO services.

These services can help businesses manage financial crises, become financially stable and provide the expertise of a chief financial officer in building financial models and forecasts.

But how much do outsourced CFO services cost?

Today’s post will cover the answer to help businesses uncover the costs of working with an outsourced CFO. And if you’re an outsourced CFO company, this guide can help you price your services.

To begin, let’s first discuss some jargon.

Courtesy of: Canva/ Andranik Hakobyan

What is an Outsourced CFO Service?

It is an outside company with Chief Financial Officer (CFO) consultants, providing CFO services to one or more businesses.

These CFOs typically have years of experience in business financial management. When hired, these outsourced CFOs often work remotely from the outside organization with the company. Thus, they’re sometimes referred to as virtual CFOs.

Outsourced CFOs (a.k.a. Fractional CFOs) usually connect with companies via shared access to accounting software.

Full-Time Outsourced CFO vs. Part-Time CFO

An outsourced CFO is usually called an interim CFO. This financial advisor typically works full-time under a contract and will be with the company or affiliate for a certain period.

During the said period, the outsourced CFO will be given control over the management and preparation of the business's financial exploits. If you’re a startup, an outsourced CFO service can come in handy.

A part-time or fractional CFO, on the other hand, works part-time. Unlike a full-time outsourced CFO, a fractional CFO works with a company for an undetermined time. They are not obligated to work with the business for eight hours a day, five days per week.

Most startups at the seed (initial capital raised) or Series A (first round after the seed stage) don’t have enough tasks that require them to work 40+ hours each week. Thus, an outsourced CFO or part-time CFO is beneficial for them.

But what are those services that an outsourced CFO provides, anyway?

Outsourced CFO Services

The role of an outsourced CFO includes

Creating and managing company budgets

Overseeing the process of bookkeeping

Choosing and maintaining financial software

Analyzing financial reports and trends

Assisting with raising capital

Negotiating with banks on behalf of the company

Preparing financial reports and creating custom financial models

Measuring what matters to your business

Suggesting preventative actions

Analyzing Mergers and Acquisitions (M&A) opportunities, including post-acquisition operations and BAU (business as usual) forecasts

Ensuring effective cash flow management, so your business doesn’t hastily borrow or never run out of cash

Reporting on profitability compared with targets

Ensuring compliance to relevant laws

Coordinating with the business owner and key decision-makers

Now that you’ve learned about the common fractional CFO services, let’s break down why they may be useful to businesses than hiring a full-time CFO.

For more read: Virtual CFO Cost Analysis: Dallas

Courtesy of: Canva/ GCShutter

Why Are Outsourced CFO Services Useful to Businesses?

Outsourced CFO services add value to different businesses in various ways, including the following:

Savings

The primary reason for hiring an outsourced CFO is cost savings. They are employed remotely and part-time, so the cost is significantly lower than a salaried employee.

Moreover, there’s no need to pay for medical insurance, taxes, paid holidays, or retirement contributions. There may also be no need to provide them with equipment or office space because their job can be performed remotely.

Expertise

An outsourced CFO generally has a CPA license, an advanced degree, or other certification and broad experience working in multiple industries. These expertise and qualifications assure you that the CFO you’ll hire will be an asset to your business.

After the initial consultation, he or she can analyze your current financial standing, develop goals, provide a financial strategy, and discuss the steps necessary for success.

Raise Capital with Ease

Fundraising is hard work, especially for startups. You have to set up a data room (digital or physical storage space to store information for due diligence), create a financial model and a pitch deck (communication tool to raise money), and research potential investors.

The good news is raising capital doesn’t have to be a one-person job. You can delegate this task to outsourced CFO services. These experts can advise you on debt and equity mix. They are also experienced and trained to craft a compelling pitch deck, beyond just visually-pleasing slides.

Data-Driven Decisions

Outsourcing CFO services provide your business with guidance and financial insights to make data-driven decisions. This allows you to increase productivity, cut costs, optimize pricing, improve operations, maximize profits, perfect time hiring, and more.

Improved Compliance

Outsourced CFOs can keep your financial reports and back office operations up to industry, local, and national regulatory standards.

They ensure that your business is compliant to prevent reputational and financial damage that may arise from non-compliance.

Internal Fraud Prevention

Startups and small and medium-sized businesses are most susceptible to internal fraud because they lack robust back offices.

Outsourcing the work ensures the books are properly handled with sound policies, procedures, and systems aside from implementing dual control. Outsourcing CFO work can also ensure proper checks and balances, shifting the burden of fraud risk to the third-party provider.

Who Benefits from Outsourced CFO Services?

Startups can create growth trajectories to attract creditors and investors.

Small businesses can switch from a full-time CFO to more flexible outsourced CFO services.

Medium businesses can outsource extra tasks even if they already have an in-house CFO for ease of work and to speed up completion.

Enterprise-level businesses can hire a virtual CFO, who can be very beneficial during important transitions.

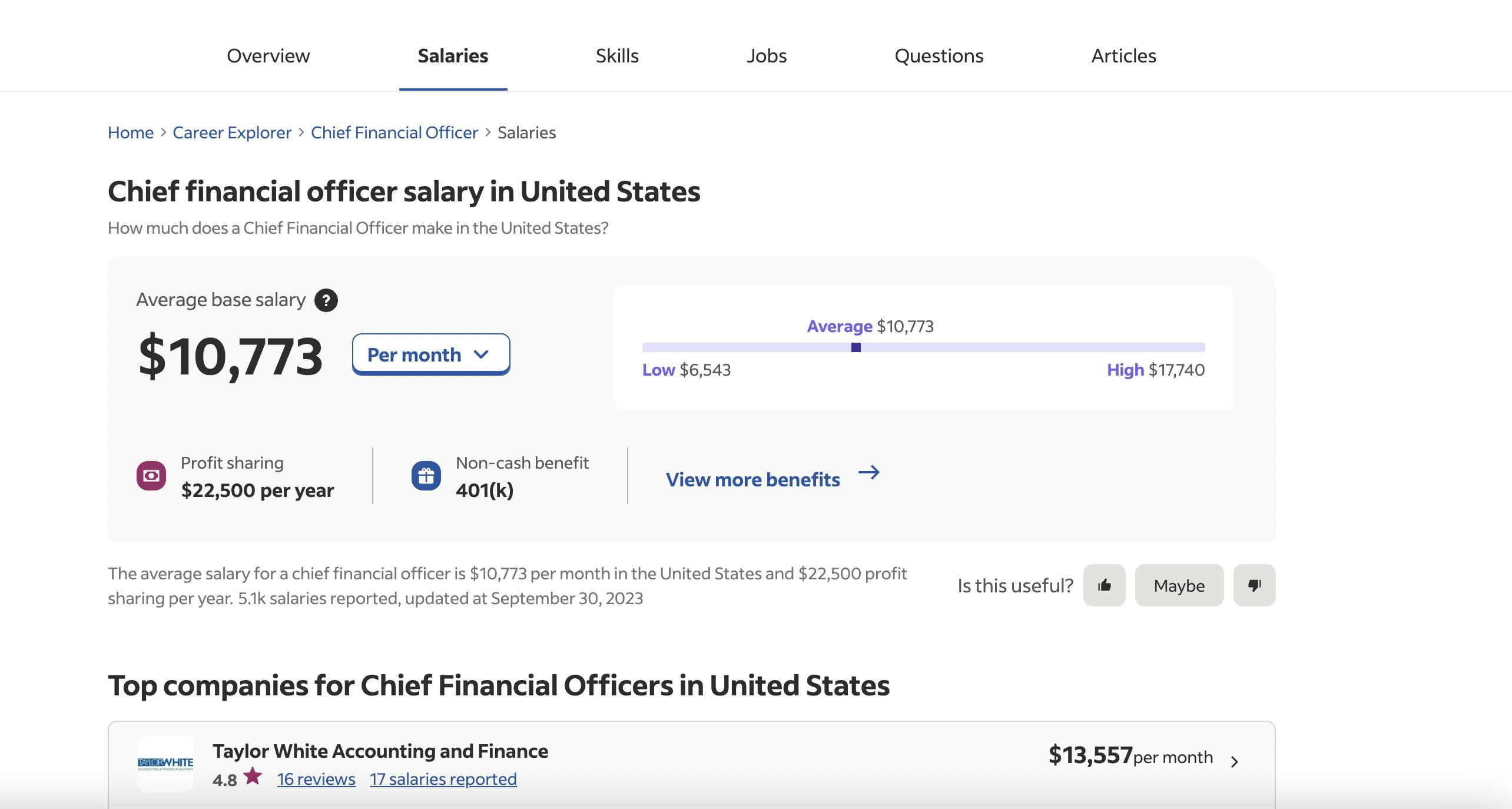

Courtesy of: Indeed

So, How Much Do Outsourced CFO Services Cost in 2023?

Outsourced CFO services typically cost $3,000 to $10,000 monthly, with retainers ranging between $5,000 to $7,500. [1]

Remember, however, that the position is flexible. The cost varies with the responsibility involved and the time spent by the full-time outsourced CFO at work.

If it’s per hour, the average base salary of an outsourced CFO is around $65.00. If it’s per year, the average base salary is $152,164.

On the other hand, the average full-time CFO in the United States costs around $433,100 annually as of September 25, 2023. The range also typically falls between $328,100 and $555, 700.

The range in salary varies widely, depending on factors such as certifications, education, years spent in the profession, and additional skills. [2]

4 Factors that Influence How Much an Outsourced CFO Costs

1. Size and Complexity of Your Business

The common elements that influence the pricing of an outsourced CFO service are the size and complexity of your business.

This usually involves asking about the number of product types you sell, whether you acquire your products from different sources, if you have multiple business partners, the number of credit lines you’re working to pay down, and the number of bank accounts your business has.

If your business grows, it also impacts numerous factors, including budgeting, forecasting, and cash flow. All these are variables that increase the estimated CFO cost.

2. Work Arrangement/ Services You Need

More meetings with the CFO will also mean higher costs. Meanwhile, the cost may be less expensive if you only need basic CFO services for a certain period.

But if you require more in-depth planning, strategy, and reporting, it will be more expensive.

3. Business Goals

What do you want to accomplish in your business by hiring an outsourced CFO? Will they be helping you in cash flow management? Will they assist you in preparing and explaining your financial statements?

Will you be turning over your strategic financial analysis to a CFO? Answering all these questions can help you better decide on the person to hire and how much the average CFO salary or cost will be.

4. Data Accessibility

The harder your inventory and advertising data are to access, the less effective the outsourced CFO will be. So, choosing systems that make your data accessible and readable can help optimize your business for an outsourced CFO service.

Is It Worth It?

Definitely, having an outsourced CFO working for your company provides value and is worth investing in.

Managing a business with inadequate financial data resembles reading a foreign language or scrambled critical news.

In this situation, you need a reliable and trusted “translator” to assist you in interpreting the data and taking action. If your financial data is well-organized and presented, it will be valuable, and it’s easier to analyze the company’s overall financial strengths and weaknesses.

Outsourced CFO: How to Vet Candidates

Qualifications

Perform due diligence when hiring an outsourced CFO service by checking the education and qualifications of the CFO. This person usually has a bachelor’s or advanced financial or business degree. Financial designations, such as a CPA, are also common.

Experience

Choose someone who has experience in the field and is updated with the best practices and latest tools.

You’ll want to hire someone with specialized skills working in your industry or target market if possible.

Internet Search/ Network

Use the Internet when looking for an experienced CFO. Check for reviews and see what people who have previously worked with them have to say.

Compile a list of firms to contact or visit. Once it is complete, check if their services match your business goals.

Case Studies

An outsourced CFO may not be as costly as a full-time CFO, but it is still a big investment.

Thus, keep looking if you can’t find case studies or reviews on the CFO service company’s website that show success and proof that their services work.

We suggest you go for evidence that it can provide impactful, real strategic advice and has strong forecasting experience.

Courtesy of: Pexels/ Artem Podrez

It’s Time to Take Your Business to the Next Level

Overall, outsourced CFO services can benefit your business. Their rates are far lower than hiring a part-time or full-time CFO to handle your financial needs. Moreover, they offer flexibility to CFO services you can avail.

If you have trouble managing cash flow, are in need of financial guidance, are facing a tough financial challenge, want help making data-driven financial decisions, or simply want to have a financial expert on your company, it may be the right time to hire a virtual CFO.

In summary, an outsourced CFO is a great option for startups and small and medium-sized businesses because they are:

- Experienced in various topics

- Actively learning from problems they’ve sold with other companies

- An affordable alternative to a full-time hire.

References:

[1] www.indeed.com

[2] www.salary.com