If you knew something that could potentially help you transform the way you see financial data, and how you apply that knowledge in your business, then you’d be willing to spend some time looking into it, right? Sure you would.

In this article, we look at ways the trial balance complements the balance sheet but also explore ways in which it differs. For SBOs this knowledge can transform the way you do your bookkeeping. You’ll make smarter decisions based on accurate financial data and you can do this without needing to become an accountant. Join us as we take a unique look at the trial balance vs balance sheet.

What is the purpose of a trial balance?

In a double-entry accounting system, the debits and credits that you enter into your general ledger accounts ensure that all financial transactions are neatly balanced. A trial balance (TB) is a one-document expression of the accuracy of your accounting records. It tells you whether your credit balances are equal to your debit balances. If not, you have made an error somewhere. This is helpful to understand BEFORE you close off your books for a certain period. However, it is not officially classified as a financial statement. It is more of an internal report.

The trial balance is sometimes confused with the Profit and Loss account. This is incorrect. The P&L account reflects the sales revenues, costs, and expenses over a certain accounting period, while the TB is a snapshot of the journal entries.

Important accounts shown in trial balances are accounts receivable and accounts payable, inventory, and cash in the bank. These totals are often where errors are found that affect the financial statements.

What is a balance sheet?

The balance sheet reflects the company’s financial position at the end of an accounting period. The balance sheet is the first report that is classified as a financial statement, along with the income statement. The balance sheet gives you a summary of the company’s assets, liabilities, and equity. It is completed once all accounts balance (as confirmed by the trial balance).

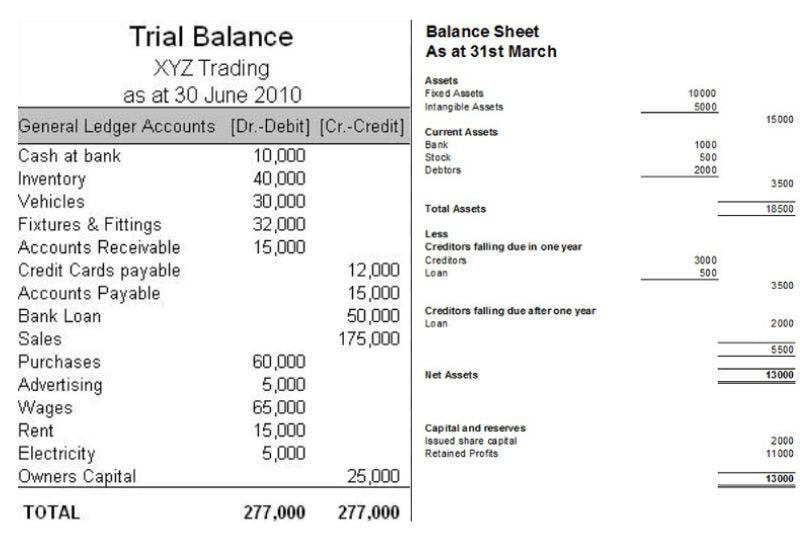

In the image below you will see a simple example of these reports. You’ll notice the trial balance lists the credit balance and the debit balance side by side in columns. In the balance sheet, the account balances are extracted to populate only certain information. The financial health of the business is clearly understood by the final line of the balance sheet which shows the company’s net worth. The trial balance and balance sheet are also drawn up at different stages in the accounting process as follows:

Journal entries

General Ledger

Trial Balance

Income Statement

Balance Sheet

Shareholders Equity Statement

Example of a simple trial balance vs. balance sheet

Is your business financially fit? Let’s do a health check using your trial balance and balance sheet. You can schedule a free consultation with us anytime.

As a SBO you might now be wondering whether you can do anything useful with this information. Stick around as we delve into some things you may not know about the trial balance vs. the balance sheet.

The trial balance can save you from paying incorrect taxes

We’ll use an example of a bakery to illustrate this point. A small artisan bakery has reflected a much higher profit than expected and therefore will have to pay higher taxes. The owner decides to review the trial balance. She immediately sees that the accounts payable balance is lower than expected and after investigation realizes that there are outstanding supplier invoices that haven’t been processed.

However, this doesn’t change the retained profit much, and the owner still has a high tax liability. Next, she checks that all the debits equal credits and then discovers a small mistake that would have cost her business thousands in unnecessary taxes. The wages account reflects that she paid $3,500 instead of $350,000. The figure is properly recorded and a tax disaster averted.

The trial balance is the answer to your mystery errors

Image courtesy of Canva/Rido

There are a number of ‘fixes’ that can be dealt with by using the trial balance. Some of these can be so obvious that you don’t see them unless you know where to look. It’s important that debits equal credits but if they don’t, try these 7 tips.

Check for duplicate transactions: One transaction could have been recorded multiple times. This is often a problem when there are multiple people doing manual data entry.

Omission of transactions: A failure to record a transaction in the accounting system may have occurred. There is more of a risk of this happening with manual record keeping.

Transposition errors: This is a common problem. Two or more figures have been reversed when entering numerical data.

Calculation mistakes: The debit and credit columns have been incorrectly tallied.

Timing differences: Transactions that belong to one financial year or accounting period may have been recorded in another.

Unrecorded journal adjustments: Forgetting to record adjusting entries for accruals or deferrals.

Mismatched currency conversion: Inconsistencies in currency conversion rates used for recording foreign transactions. This can be especially tricky if meticulous records are not kept of the conversion rate on the date the transaction was concluded.

A single error can change the entire financial outlook for your business. That doesn’t have to happen if you have meticulous bookkeeping services.

The adjusted trial balance is the final check before creating financial statements

The adjusted trial balance includes all ledger accounts, both permanent (balance sheet) and temporary (income statement), with their updated balances after adjusting entries. Preparing an adjusted trial balance involves several steps. First, adjusting entries are recorded in the general journal to reflect accruals or deferrals that were not initially captured during the accounting period. These entries are then posted to the appropriate ledger accounts. Next, the adjusted balances of all accounts are listed in the trial balance columns of the worksheet, with debits and credits balanced to ensure accuracy.

A TB can be created at any time during an accounting period to check the accuracy of data. However, an adjusted TB is completed as a last step to closing off accounts and before the financial statements are drawn up.

The Balance Sheet is like a biography of your business

The balance sheet narrates the journey of your business showing where it has been, where it is today, and where you can take it into the future.

Here are some ways you can use the information in your balance to make better business decisions.

Past: Understanding your business’s operating history

The balance sheet offers a retrospective look at what your business has accumulated over time—assets, liabilities, and equity. This historical perspective shows:

Capital investments - how much money has been invested into the business and what has been done with it gives SBOs an idea of how capital has been put to use

Debt history - understanding how and when you incurred debts and whether you managed the debts give you an indication of your company’s ability to meet its financial obligations

Asset accumulation - a steady progression of acquiring assets reflects that your company is developing and expanding financially.

Present: Snapshot of your business’s financial health

What you own vs what you owe is an important aspect of running a small business. The balance sheet provides this information.

Liquidity - What access to cash and liquid assets your business has available to cover day-to-day expenses

Solvency - By examining liabilities in relation to assets, you can assess your business’s solvency, ensuring that it isn’t heading towards financial distress.

Future: Forecasting and Strategic Planning

You want to make important business decisions that might include expansion, but you need accurate financial figures to do this. The balance sheet provides the data you need for a look into the future.

Growth Opportunities - underutilized assets and excessive capital retention may signal an opportunity for expansion.

Risk Mitigation - In business timing is everything. Based on current liabilities you can plan debt repayment more accurately.

Investment Potential - Potential investors always request the balance sheet along with the income statement and cash flow statement. They are interested in the quality of your assets, debt levels, operational efficiency, retained earnings, and shareholder’s equity. For this information, they look to the balance sheet accounts.

The type of industry dictates the structure of the balance sheet

Image courtesy of Canva/Getty Images

The type of industry will dictate the structure of your balance sheet. The reasons are related to the types of assets, the capital structure, revenue recognition, and risk factors faced by each industry that must be shown on the balance sheet. Let’s look at three types of industry, namely: manufacturing, retail, and services.

Manufacturing Balance Sheet Example:

Assets | Liabilities and Equity |

Current Assets | Current Liabilities |

Cash, Accounts Receivable, Inventory, Prepaid expenses | Accounts payable, short-term debt, accrued expenses, current portion of long-term debt |

Fixed Assets | Long-term liabilities |

Land, buildings, machinery, vehicles | Long-term debt, deferred tax liability |

Intangible Assets | Equity |

Patents, Trademarks | Share capital, retained earnings, treasury stock |

Retail Balance Sheet Example:

Assets | Liabilities and Equity |

Current Assets | Current Liabilities |

Cash, Accounts Receivable, Inventory, Prepaid expenses | Accounts payable, short-term debt, accrued expenses, current portion of long-term debt |

Fixed Assets | Long-term liabilities |

Retail Store, warehouse, office equipment | Long-term debt, deferred tax liability |

Intangible Assets | Equity |

Brand, customer relationship value | Share capital, retained earnings, treasury stock |

Services Balance Sheet Example:

Assets | Liabilities and Equity |

Current Assets | Current Liabilities |

Cash, Accounts Receivable, Inventory, Prepaid expenses | Accounts payable, short-term debt, accrued expenses |

Fixed Assets | Long-term liabilities |

Office space, furniture, computers | Long-term debt, deferred tax liability |

Intangible Assets | Equity |

Brand, intellectual property | Share capital, retained earnings, treasury stock |

The Balance Sheet can help you with tax planning

Tax planning is a critical element for small businesses. The balance sheet is a powerful tool for guiding SBOs into comprehensive tax planning initiatives for the future. Here are just two ways that you can plan strategically to reduce your tax liability.

Liabilities such as loans, lines of credit, and other forms of debt are also reflected on your balance sheet. By managing your debt effectively and tracking interest expenses, you can identify opportunities to deduct interest payments from your taxable income. Additionally, refinancing debt or restructuring liabilities can help optimize your tax position and reduce overall tax liabilities.

Working capital management plays a crucial role in tax planning, particularly for businesses with inventory-intensive operations. By monitoring inventory levels and turnover ratios, you can optimize inventory management to reduce taxable income. Additionally, strategic timing of inventory purchases and sales can impact tax liabilities, allowing you to defer income or accelerate deductions as needed.

Comprehensive bookkeeping and taxation services will keep the IRS off your back and help you sleep better at night. Schedule a consultation to discuss how you can concentrate on doing what you love, while we look after the books and the tax.

Final Thoughts

You will notice from our article the key difference between the trial balance and the balance sheet is what they are used for. One is an internal report that allows bookkeepers to check the accuracy of financial transactions and the other is a financial statement that is used to make important business decisions.

At Hall Accounting Company, we understand the challenges that small business owners face in navigating the complexities of financial management and tax planning. Our team of experts is dedicated to providing comprehensive bookkeeping and taxation services tailored to your unique needs, ensuring that you can focus on what you love while we handle your books.

The value of outsourcing your accounting becomes apparent when you consider that you could have all your day-to-day financial transactions accurately captured, your tax liability carefully managed and your financial statements drawn up for you. Not only that, but we will also proactively consult with you about expansion opportunities, investments and help you manage any out-of-control expenses that could be affecting your bottom line.

Let’s discuss your needs as soon as possible.