The Texas Franchise Tax (TFT) is a tax imposed on a taxable entity formed or organized in the state of Texas. It is based on “margin”; not income, profits, or revenue. It is sometimes referred to as “privilege tax” because it is levied for the privilege of doing business in Texas. The annual franchise tax report is due on May 15 of each year.

This tax which is applicable to corporations, LLCs, and partnerships have an impact on the financial obligations of the business and therefore makes it a topic of interest. In this quick guide, we discuss important information you need to know to meet your tax obligations.

If you feel like this crucial deadline might escape your to-do list, or you would rather pass on your business taxes to a competent local business, you can hire Hall Accounting Company.

Why do you need to pay franchise tax in Texas?

The Lone Star state has been an attractive option for businesses to register their trading concerns for many decades. According to the Texas Economic Development Corporation major companies have relocated their business to Texas in recent years. Names such as Toyota, Apple, SpaceX, HP, and Tesla are on that list. [1]

Why did they make this decision? Because Texas makes it easy to be successful. Among other things there is no personal income tax, no corporate state income tax, and a very reasonable regulatory climate. Surprisingly, Texas is the 8th largest economy in the world according to GDP, and it places a high value on infrastructure development.

Taking all these factors into account, it is considered a privilege to do business in Texas and that is why a franchise tax exists.

Who must pay the franchise tax in Texas?

The following taxable entities must file the Texas franchise tax report:

Corporations (including S-Corps and professional corporations)

Limited Liability Companies

Banks

Savings and Loan Associations

Partnerships

Trusts (including a self-insurance trust - Insurance Code Chapter 2212)

Business Associations

Professional Associations

Joint Ventures

Entities not subject to franchise tax

There are certain entities that are not required to pay Texas franchise tax. These exemptions have been designed to encourage business activities but lighten the administrative load on small businesses. Exempt businesses fall into five broad categories:

They meet the no-tax-due threshold. The threshold is currently set at $1,230,000.

They are registered as an exempt business type e.g. sole proprietors

They are considered exempt for state-federal income tax purposes e.g. a non-profit organization.

They are veteran-owned

They are considered a passive entity such as unincorporated political committees

Hire us for expert tax compliance. Our team is equipped to handle all your business taxation obligations. You can do what you love and we’ll handle the tax deadlines and file your reports. This is one service all businesses should outsource. Call us today to discuss your needs.

How to calculate franchise tax rates

Privilege tax imposed on businesses is done according to business margins (total revenue after deductions). Primarily it is calculated using one of two methods: the E-Z Computation or the standard deduction method.

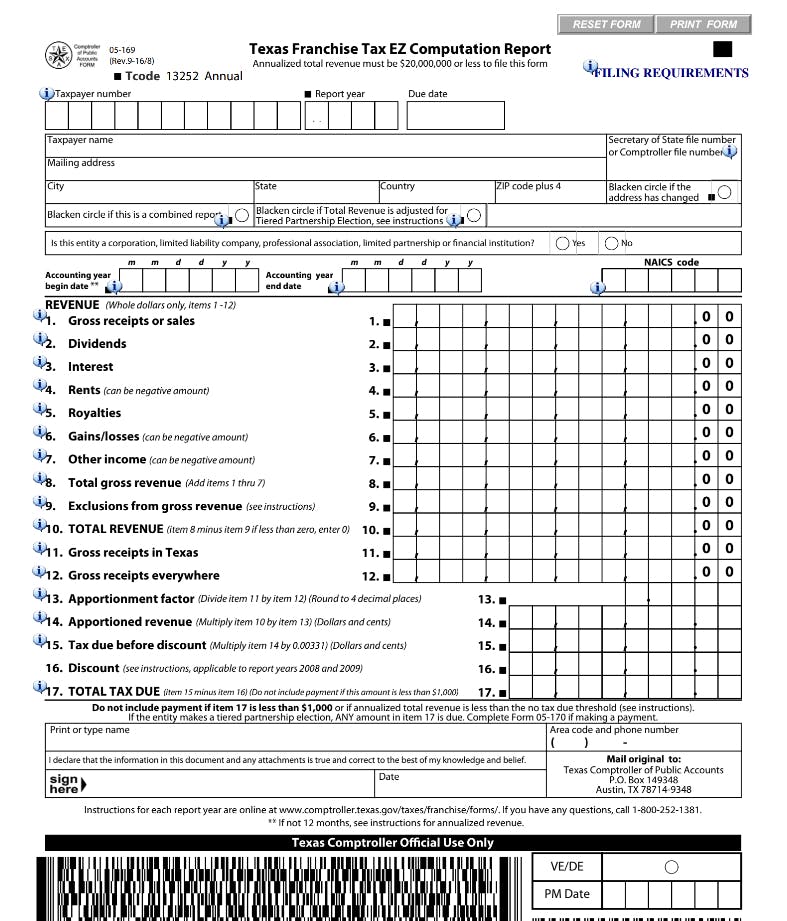

E-Z computation

The E-Z Computation method is simpler and can be used by entities with total revenue of $20 million or less. This method applies a tax rate of .331 percent to all Texas-based earnings.

Standard deduction method

The standard deduction method is for businesses with a revenue above $1,230,000 and allows for deductions such as cost of goods sold or the employee compensation deduction, and is calculated as follows:

Total Revenue Times 70%

Total Revenue Minus Cost of Goods Sold

Total Revenue Minus Compensation (does not include 1099 labor or payroll taxes paid by the employer)

Total Revenue Minus $1 Million

The rates are .0375 percent (for qualifying retail or wholesale businesses), or .75 percent (for all other businesses).

Earn franchise tax credits

There are several ways to earn franchise tax credits. You can apply for these tax credits via the office of the Texas Comptroller. [2]

Credit Type | Must be established by |

Qualified research and development activities (tax code chapter 171) | December 31, 2026 |

Historic structure rehabilitation | No expiration date |

Clean energy projects | No expiration date |

How to file franchise tax reports

Your business may not owe any franchise tax but this does not mean you can skip on filing the annual franchise tax report. The first steps are the same for all businesses.

1. Receive your franchise responsibility letter from the Comptroller

Shortly after your business is approved you will receive a franchise responsibility letter. This letter will help you set up your franchise tax account. This letter will inform you of:

Your 11-digit Texas taxpayer ID number.

Your WebFile number. The first time you file this number begins with “FQ”, and then you receive a permanent number that begins with “XT”.

2. Create your account and file the franchise tax questionnaire

Example of an EZ Computation Report

The questionnaire serves two purposes: it helps the Texas Comptroller determine your business’s franchise tax obligations, and it gives you a chance to update the mailing address the Comptroller has on file for your business. You have 30 days to create this account after your business is approved.

If you DON’T need to pay franchise taxes:

File a No Tax Due Report (Form 05-163) as well as a Texas Franchise Tax Public Information Report (Form 05-102).

If you DO need to pay franchise taxes:

Decide which method of computation you will use (as discussed above) and file either the E-Z Computation Form or the Long Form Report (05-158A). Franchise tax is an annual payment and therefore you do not need to make quarterly estimated payments.

The calculation of franchise taxes can become complicated. If you would rather get some help with your business taxes, you can get help from Hall Accounting Company at any time.

Schedule a FREE consultation now

A final word from Hall Accounting Company

Don’t let the franchise tax deadline pass you by. This ‘privilege tax’ holds great importance for government initiatives and the development of infrastructure throughout the state of Texas. As an SME your focus shouldn’t have to be on tax deadlines, when it needs to be on key business activities that generate revenue, and help you to build a sustainable business for generations to come. How can you do this?

Outsource your accounting and taxation!

As a local accounting firm, we stay on top of all accounting and taxation legislation and can help you manage not only your tax obligations but also your day-to-day bookkeeping. Whether you're in Houston, Fort Worth, or Dallas, our experienced CPA firm is here to assist you. Give us a call before another tax deadline rolls around.

References:

1. Texas reigns as the best state for business

2. https://comptroller.texas.gov/taxes/franchise/credits.php