If you’re wondering what the tax rate is for payroll in Texas, the main state tax you need to know about is the Unemployment Insurance (UI) tax. You’ll also still need to manage federal payroll taxes like Social Security, Medicare, and FUTA. This article will guide you through everything you need to know about these taxes, how they’re calculated, and tips for staying compliant as a Texas business owner.

Hey everyone! If you're running a business in the Lone Star state, you've probably got a lot on your plate-growing your team, keeping customers happy, and making sure everything's running smoothly. But there's one thing that might not be top of mind, even though it's super important: Payroll taxes.

Now I know payroll taxes aren't the most exciting topic, but trust me, getting them right is crucial for keeping your business out of trouble and running like a well oil machine. Whether you're just starting out or you've been in the game for a while, understanding these details will help you stay on top of your responsibilities and avoid any nasty surprises.

And if you ever feel like payroll is more of a headache than you want to deal with, that's where Hall Accounting company can partner with you. We offer tailored payroll services that take the stress off your shoulders, so you can focus on what you do best-growing your business. Check us out at www.hallaccto.com to learn more about how we can help you keep your payroll running smoothly.

What is the tax rate for payroll in Texas?

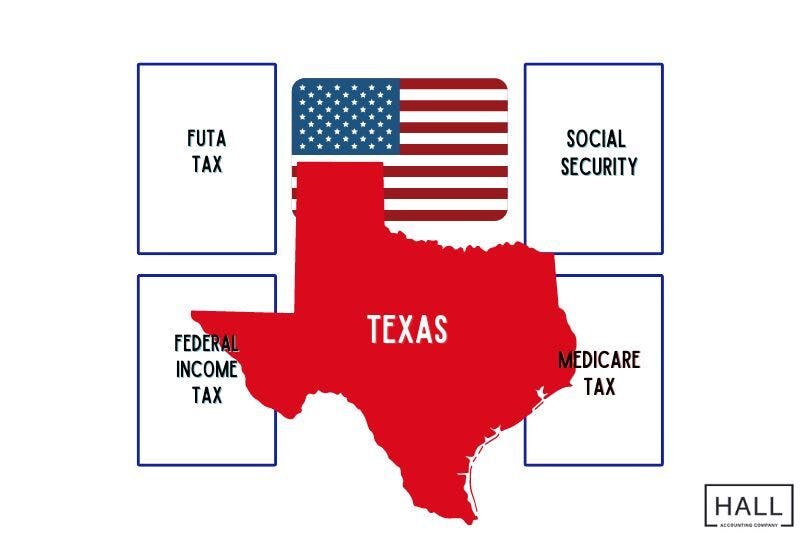

Let's start with the basics. In Texas we don't have a state personal income tax which is a big plus for both employers and employees, however, that doesn't mean we're off the hook when it comes to Texas payroll taxes.

The main state income tax you need to know about is the Unemployment Insurance tax (UI). This tax is your responsibility as an employer, and the rate can range from 0.31% to 6.31% on the first $9,000 of each employee’s wages. The exact rate you pay depends on your business’s history including factors like layoffs and your overall experience rating.

Unemployment Insurance Tax

Understanding your Unemployment Insurance tax rates is crucial because it can significantly impact your business’s finances. The Texas Workforce Commission sets this rate each year taking into account the overall economic conditions and health of the Unemployment Insurance Trust Fund. Additionally there are components like the general tax rate, the replenishment text rate, employment training investment assessment, and the obligation assessment rate that all factor into your total UI tax bill.

General Tax Rate: The base rate applied to all employers.

Replenishment Tax Rate: Helps replenish the state’s unemployment trust fund.

Obligation Assessment Rate: Covers all outstanding debt related to unemployment benefits.

Deficit Tax Rate: Imposed in the unemployment trust fund falls below a certain level, although this is rare.

Employment Training Investment Assessment (ETIA): A small percentage of taxable wages added to support workforce training programs in Texas.

ETIA in more detail

Perhaps you’ve never heard of this initiative? ETIA is used to support the TWC’s skill development fund, which provides grants to community and technical colleges to offer customized training programs for businesses.

The ETIA is calculated as a percentage of the taxable wages reported by employers and is included as part of the overall Unemployment Insurance (UI) tax rate. It’s a small additional charge that Texas employers pay to contribute to the ongoing training and upskilling of the workforce, which benefits both employers and employees by enhancing skills and employability.

The exact amount may vary annually, and it is usually combined with other UI tax rates when reported and paid. This tax ensures Texas workers have access to valuable skills that meet the demands of Texas’s booming economy.

How to pay Unemployment Insurance tax

The UI tax in Texas is administered by the Texas Workforce Commission. The TWC is responsible for collecting UI taxes from employers, managing the state Unemployment Insurance Trust fund, and distributing unemployment benefits to eligible workers who lose their jobs through no fault of their own.

Texas employers are required to report and pay their UI taxes on a quarterly basis. If you are a new employer, you must register with the Texas Workforce Commission as soon as you hire your first employee. This can be done through the TWC website. Once registered, you'll receive a Texas employer number, which you'll use for all your UI tax reporting and payments.

Reporting deadlines

The wage report includes information on each employee’s total wages for the quarter and is used to calculate the UI tax owed. You must pay state unemployment taxes promptly to avoid penalties as per the Texas Unemployment Compensation Act. The quarterly wage reports are due by the last day of the month following the end of each calendar quarter:

1st Quarter: April 30

2nd Quarter: July 31

3rd Quarter: October 31

4th Quarter: January 31 of the following year

Employers can file the quarterly wage reports and pay UI taxes online through the TWC’s unemployment tax services portal. This is the most convenient method and allows for electronic payments via Automated Clearing House debits.

While online filing is encouraged, employers who prefer paper filing can still submit their wage reports and payments via mail. However, this method may take longer to process.

Tax rate notice

Each year, the TWC sends employers a Tax Rate notice that details their UI tax rate for the upcoming year. This notice includes a breakdown of the various components of the rate and is based on the employer’s experience rating, industry, and the overall health of the state’s unemployment trust fund.

Record-keeping

Accurate records of all wages paid to employees, as well as UI payments must be kept by the employer for a period of four years. The TWC can request to audit your documents at any time, and penalties are imposed for incomplete records.

Other considerations

Worker’s compensation

Although not a tax, Texas employers may opt to provide workers' compensation insurance. This is not mandatory in texts, but it is a common practice to protect both the employer and employee in case of work related injuries.

Property Tax

While not directly related to payroll, property taxes are another significant tax that businesses in Texas may be subject to, depending on the value of the property they own.

Federal Income Taxes

But that's not all. In addition to state taxes, you’re responsible for federal income tax. These include Social Security and Medicare taxes often referred to as FICA taxes- and the Federal Unemployment Tax Act tax (FUTA). Let's break these down.

Social Security tax

Social Security taxes are currently 6.2% for both the employer and the employee, up to a wage base limit of $160,200. This tax is crucial for funding retirement benefits, disability insurance, and survivor benefits.

Medicare tax

Then there's the Medicare tax, which is 1.45% for both employers and employees, with no wage limits. If you have employees earning more than $200,000 a year, you'll need to withhold an additional 0.9% for the additional Medicare tax.

FUTA unemployment tax

There’s also the Federal Unemployment tax (FUTA), which is 6% on the first $7,000 of each employee’s wages. However, if you're paying your state UI taxes on time, you can qualify for a credit that reduces your tax rate to just 0.6%. This is a great way to reduce your overall tax liability, but it hinges on staying compliant with your state tax obligations.

Federal Income Tax Withholding

Employers are also responsible for withholding federal income taxes from their employees’ wages. The amount withheld depends on the employee’s filing status, earnings, and the information provided on their W-4 form.

The IRS provides tax tables and withholding calculators to help employers determine the correct withholding amounts. Unlike FICA and FUTA, federal income tax withholding is not a flat rate and varies widely based on individual circumstances.

Federal compliance vs. state compliance

As a business owner you are responsible for filing both state and federal taxes as required by legislation. Compliance is key when it comes to payroll tax regulations. Missing deadlines, underreporting, or failing to withhold the correct amounts can lead to significant penalties and interest charges.

That's why it's so important to stay on top of your payroll tax obligations, but we also understand that deadlines get away from you. At Hall Accounting Company, we help our clients manage this process with ease. We offer advanced payroll software that automates calculations, ensures compliance, and provides real-time insights into your payroll.

State and federal tax records and filings must be kept for four years. This isn’t just about accurate paperwork but protects your business if you are audited.

Strategic payroll management

Managing these obligations isn't just about staying tax compliant- it's also about protecting your business’s bottom line. Payroll taxes directly impact your cash flow, and every payday you need to ensure you are withholding the correct amounts and matching certain contributions as the employer. For instance, social security and Medicare taxes-or FICA taxes- represent a significant portion of payroll expenses. Matching these contributions can double your expenditure.

When it comes to minimizing the financial burden of payroll taxes, strategic payroll management is key. By optimizing employee tax credits and utilizing advanced payroll software, you can significantly reduce costs while ensuring compliance with all the necessary regulations.

For example, businesses that maintain a stable workforce and minimize layoffs can actually lower their UI tax rate over time. And by paying your UI taxes on time, you can qualify for a FUTA tax credit, which helps reduce your federal tax liability. These are just a few strategies that can make a big difference.

Outsourcing your payroll will save you money and time

In this article, we’ve been discussing the different payroll tax rates for the Lone Star state. There are a number of taxes that you need to keep up with as a business owner, and this can take your attention away from your core business.

If there is any case to be made for outsourcing accounting tasks, then payroll is the function you should consider handing over to professionals. Anytime you have deadlines looming, but you don’t have the skills or resources to meet these deadlines, it will end in you losing money.

Not only that, but accurate payroll practices keep unions and other watchdog organizations off your back. It also gives you a better reputation as an ethical and sound employer which means you can attract better talent. This might not seem like a big deal when it’s you and maybe a handful of other employees, but hopefully, you will grow and then you’ll need a reputation as a good employer.

Payroll mistakes can be costly to fix and when it comes to withholding of federal or state taxes that need to be corrected, this can lead to a lot of stress and unnecessary frustration. Professionals dedicated to your payroll will do quality checks and pick up errors before they become a problem.

If you’re ready to take control of your payroll, or if you just want to make sure everything is in order, give us a call or visit us at hallaccto.com. We’re here to make your life easier.

And another thing—your first consultation is on us. It’s a great opportunity to discuss your payroll needs and see how we can help. Thanks for your time, and we look forward to working with you.